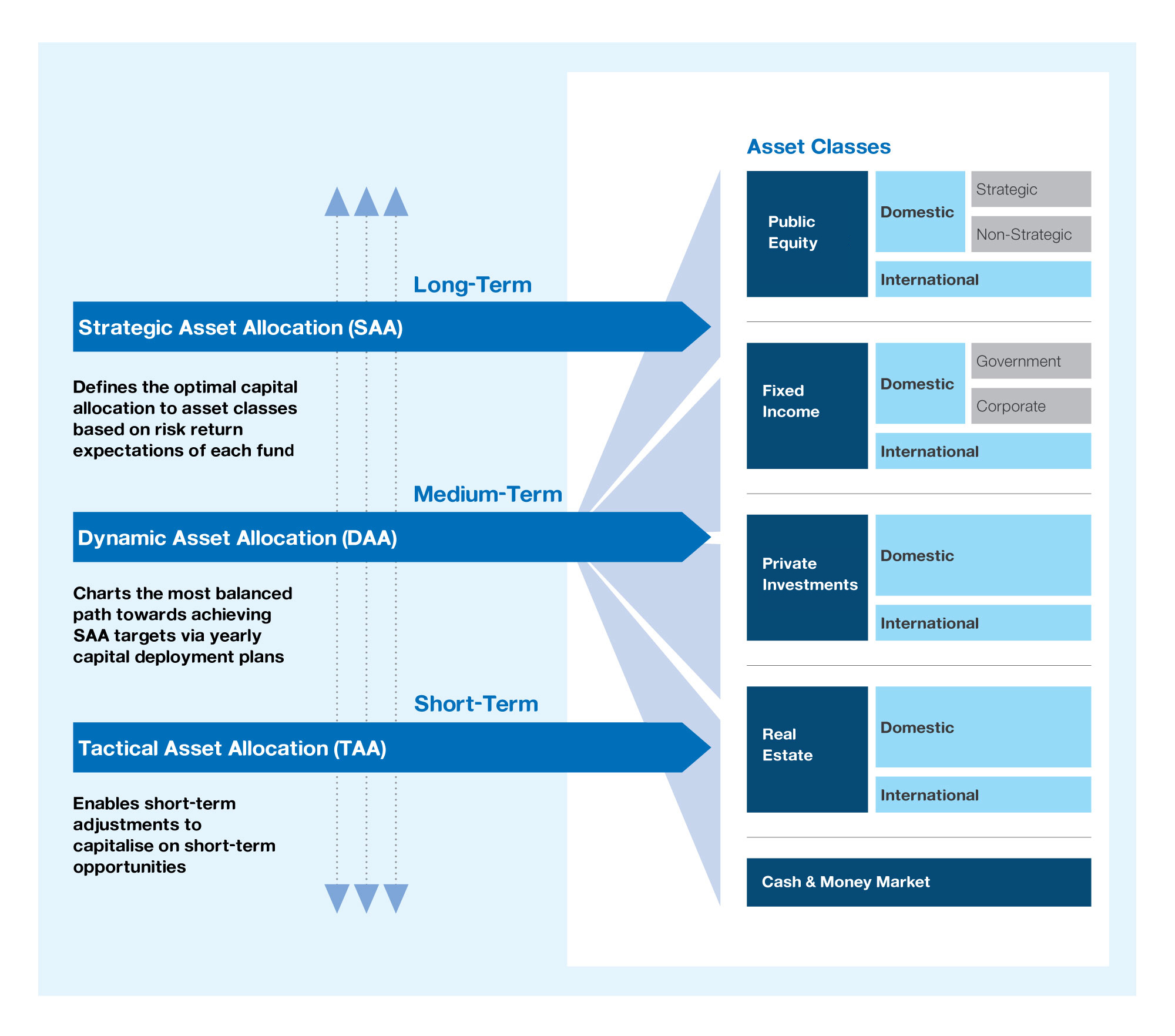

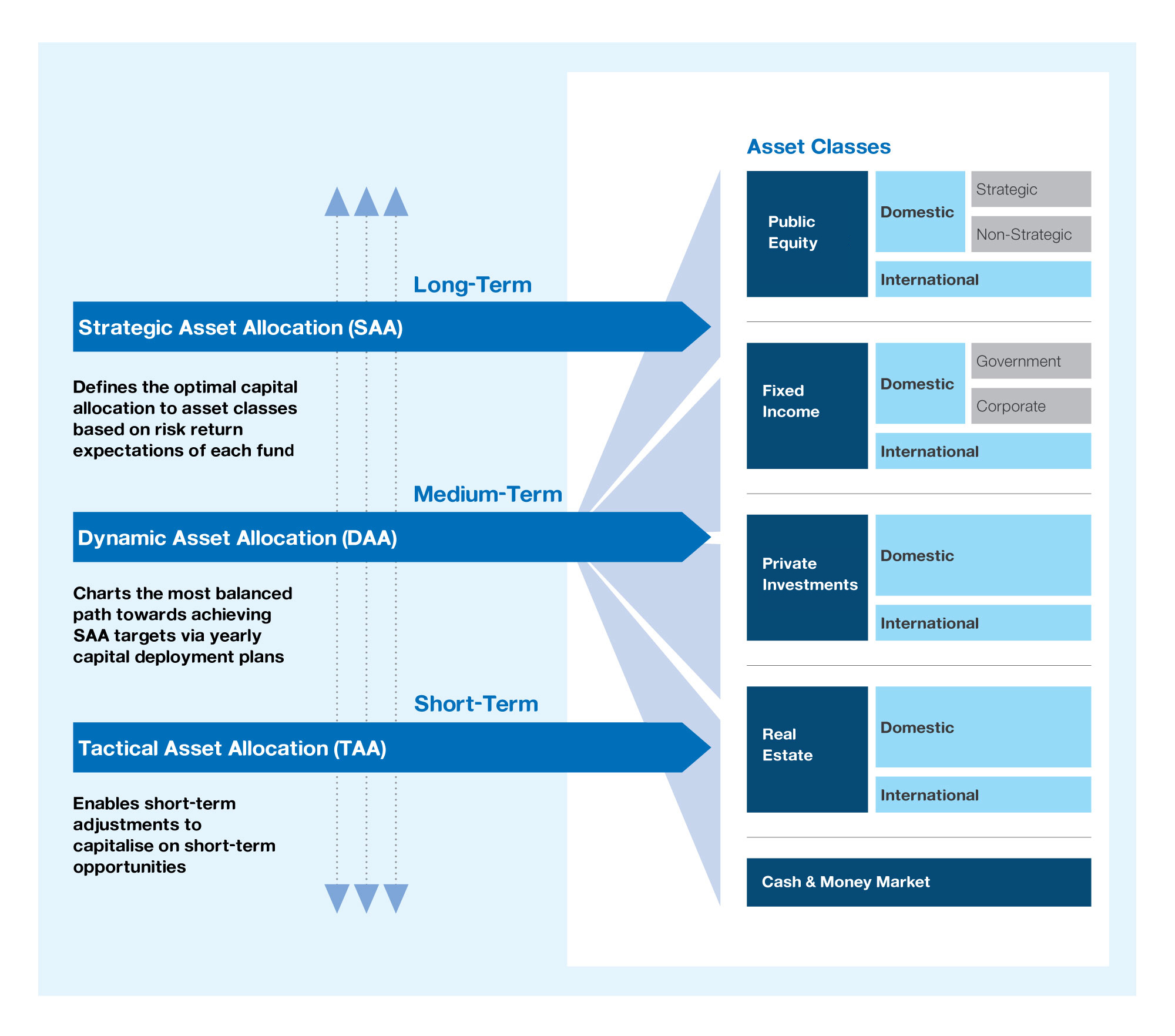

PNB's SAA Framework guides the decision-making process of setting optimal long-term capital allocation targets. It plays an essential part in PNB's initiative to achieve better diversification of risk from its portfolio of investments across different asset classes.

Optimal SAA targets for each respective fund are tailored to take into account the defined risk appetites, return targets and investment constraints of the funds under PNB's management. This is in turn supplemented by our view on the short- and longer-term outlook, as well as expectations of risk and return levels across capital markets and asset classes that we are invested in.

PNB's SAA process is built effectively around our strong belief in cultivating a culture of cross collaboration and collective accountability across the organisation. This is essential in ensuring resources and skills are fully aligned and focused in fulfilling the objectives of our funds and ultimately the expectations of our unit holders.

Through this structured and inclusive approach, we are able to continuously establish a more informed and up-to-date view on underlying factors driving expected risks and returns across all the asset classes that we invest in, leading to enhanced allocation decisions. As a result, this allows our funds to be better positioned to maximise diversification benefits towards achieving the optimal risk-return balance, hence setting the stage for continuing, sustainable returns in the years to come.